Table of Contents

- Ato Tax Brackets 2024/25 - Elita Aurelie

- Income Tax Rates Australia 2024 - 2024 Company Salaries

- Australian Income Tax Rates 2024 25 - Printable Online

- Australian Income Tax Rates 2024-25 - Rafa Ursola

- Australian Tax Brackets 2024 25 - Poppy Cariotta

- A Beginner's Guide to Understanding Australian Income Tax 2024 - YouTube

- Australian Income Tax Brackets & Rates (2024-2024)

- Australia Income Tax Calculator 2025

- Ato Tax Brackets 2024-25 - Lilah Pandora

- Income Tax Rates Australia 2024 - 2024 Company Salaries

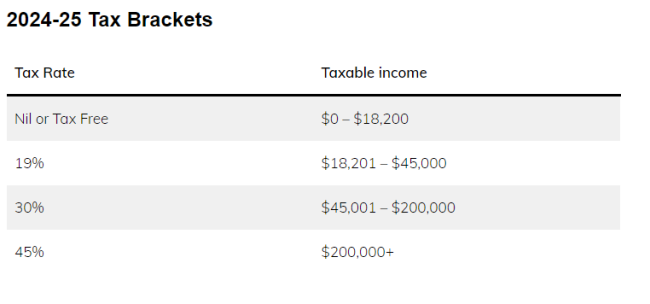

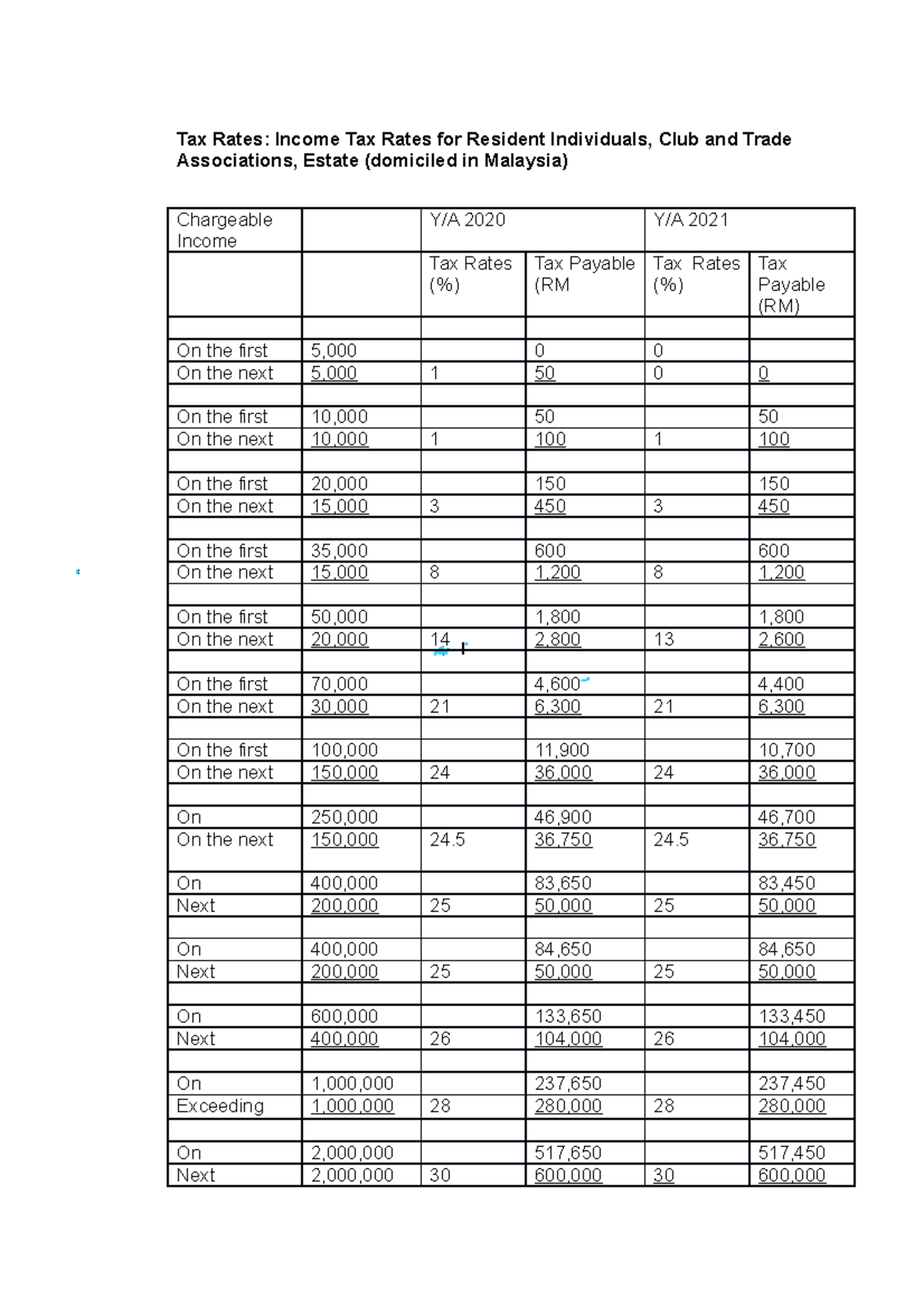

Understanding Tax Brackets in Australia

- 0 - $18,201: 0% (tax-free threshold)

- $18,201 - $45,000: 19% (basic tax rate)

- $45,001 - $120,000: 32.5% (middle tax rate)

- $120,001 - $180,000: 37% (higher tax rate)

- $180,001 and above: 45% (top tax rate)

Changes to Tax Brackets for 2024-25

Implications for Australian Taxpayers

The updated tax brackets for 2024-25 have significant implications for Australian taxpayers. Individuals with taxable incomes below $45,000 will benefit from the lower tax rate, while those with higher incomes will be subject to the increased tax rates. It's essential for taxpayers to review their financial situation and adjust their tax planning strategies accordingly.

Tax Planning Strategies for 2024-25

To minimize tax liabilities and maximize refunds, Australian taxpayers can consider the following tax planning strategies:- Contribute to superannuation: Making voluntary superannuation contributions can help reduce taxable income and lower tax liabilities.

- Claim deductions: Claiming eligible deductions, such as work-related expenses and charitable donations, can help reduce taxable income.

- Utilize tax offsets: Tax offsets, such as the low-and-middle-income tax offset (LMITO), can provide additional tax savings.